Sally’s Beauty Credit Card

If you’ve ever been to a Sally’s Beauty, you know that they try to get you to apply for their credit card every time you make a purchase. I like Sally’s Beauty. I dye my own hair. Sally’s Beauty is a serviceable one-stop shop for all my hair dye needs. Sally’s Beauty offers products that go beyond the box dye horror show you’ll find at most drug stores.

And one day, after years of being asked, I decided to humor the insistent cashier and go ahead and apply. Of course, I was approved. I have good credit. Whatever, I told myself. I’ll sign up and get whatever perks come with a Sally Beauty credit card.

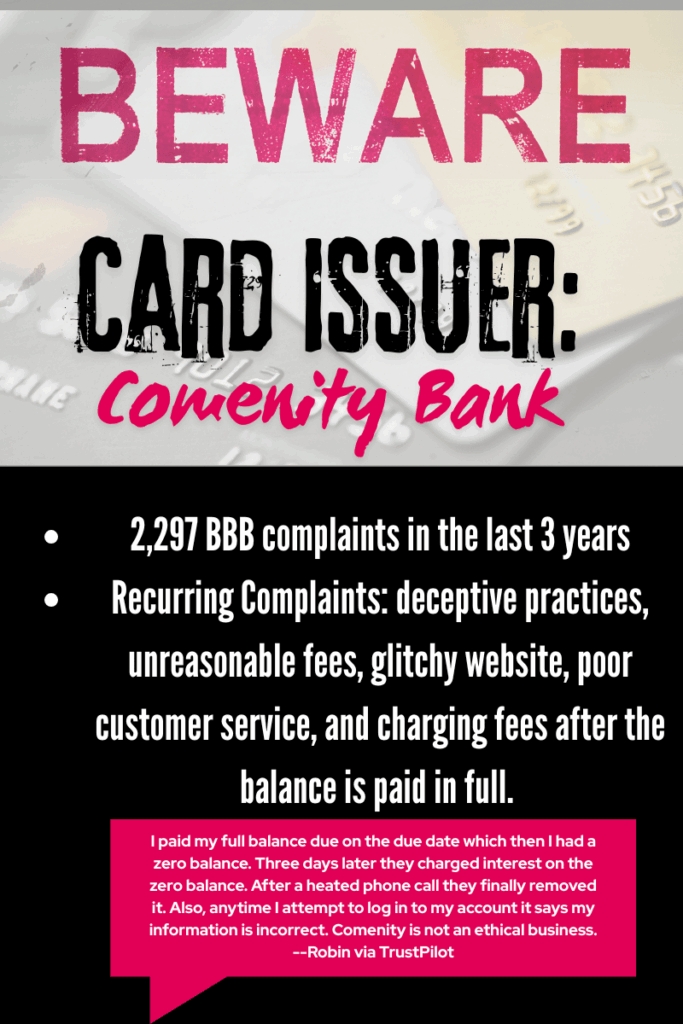

I am here to warn you that this is a program through Comenity Bank. Comenity Bank is an institution known for unethical and problematic practices. There are thousands of consumer complaints against Comenity Bank.

Sally’s Beauty Credit Card Is Issued by Comenity Bank

Comenity Bank is in the business of managing store-branded credit cards for companies. They are also known for shady business practices. Sally’s Beauty has partnered with them to handle their store-brand credit card. Sally’s Beauty is far from the only store-brand credit card that partners with Comenity Bank. Big names like IKEA, Sephora, Academy Sports + Outdoor, Carter’s, and more allow their credit to be handled by Comenity Bank.

The Reality

Sally’s Beauty credit cards and other store-brand credit cards are marketed to loyal customers as convenient and often come with offers of rewards and savings.

These store-brand credit cards actually hide a hidden reality. Credit terms include fees that are higher than what’s fair or sometimes legal. Consumers complain of shady dealings with late fees. Interest rates charged are often much higher than on regular credit cards. What’s more, Comenity has a poor track record with handling customer service. Complaints echo similar practices, indicating company policy and systemic operating procedures. The most concerning is Comenity Bank charging fees and consumers incurring fines even after their accounts have been paid off in full.

In my personal experience, Comenity’s website often doesn’t operate properly. I never got a bill from them. When I went to their website, I could not make a payment. I got hit with a $41 late fee, when it was their fault I was unable to pay. I’ve paid off my account fully now, paying a ridiculous amount for what was originally $60 charge. I will report back if they try to charge me anything further.

I’m far from the only consumer to experience issues with Comenity Bank. Over the last 3 years, they have had a staggering 2,297 Better Business Bureau complaints made against them. The reviews and complaints share common themes: deceptive practices, unreasonable fees charged, payments made on time but Comenity reports them as “late” and then charges late fees, website and payment systems are glitchy, poor customer service, and charging fees after the balance is paid in full.

In other words: Beware.

Legal / Regulatory Context

Trade rulings and federal regulations like the CARD Act and CFPB guidance set standards for what counts as “reasonable and proportional” late fees. If a credit card company charges fees that are over certain thresholds, especially if the consumer is not fully informed, they are operating unethically and exploitatively. Beyond ethics, they could also be operating illegally.

Excessively high fees and higher-than-normal interest rates disproportionately harm cardholders, especially those with small balances. Ethical implications aside, a consumer’s trust in a brand can be massively impacted by doing business with a company clearly out to deceive consumers. Businesses spend years building feelings of customer loyalty only to destroy them with partnerships like this.

The Customer Impact

Regular Sally’s Beauty shoppers are often the ones to finally apply for their in-store credit. These consumers are regular folks: single parents, office workers, teachers, students, and small business owners. It is reasonable that an everyday consumer should not anticipate predatory terms on a credit card they get for a brand they are loyal to.

Fees can quickly add up, turning a small missed payment into significant debt. And it’s exceedingly frustrating and feels like a betrayal of trust to be exploited by a company that a consumer once felt loyalty for. It doesn’t even matter that it’s actually Comenity doing the exploitation, not the brand the customer is loyal to; it still harms their confidence in that brand. A Sally’s Beauty credit card should actually reward their loyal customers, not cause undue hardship and emotional stress.

A Pattern with Comenity

Comenity has a reputation for these exact types of complaints with all its store-branded cards. I am here to write about my Sally’s Beauty card mistake, but it’s part of a wider pattern. I wish this were a one-off issue, but a small amount of research uncovers that it’s part of Comenity’s systemic practices.

Know Your Rights as a Consumer

Please, consumers, listen up. Know your rights under federal law. If you find yourself being jerked around by this shady company, there are possible steps you could take for recourse.

- Filing a complaint with the CFPB

- Contact state consumer protection agencies

- Dispute unfair fees.

You might have to get on the phone with their unhelpful customer service. The best alternative I can think of is to avoid using a Comenity-issued store-brand credit card at all.

I am talking to you, Sally’s Beauty et al.

I am disappointed, but not shocked, that you have put your trust in a bank like Comenity that regularly employs these questionable practices. You should know better. Ultimately, consumers can’t change Comenity’s systemic practices. But all the companies that have contracts with them could. I encourage you and all the other trusted brands that use this questionable financial partner to hold them accountable for their practices, because it harms YOUR brands.

In the End

Customers deserve fair credit products, not hidden traps. My loyal readers, please be cautious before signing up for store-branded credit cards. A Sally’s Beauty credit card is not a good deal. Feel free to comment and share your experiences, and please, spread awareness about this issue and push for accountability.

I don’t post things like this often. I am more likely to post a book review or my jewelry, Faebee Jewelry. But every so often, my readers need to know something like this. I’m never afraid to report on unethical businesses doing unethical things. Consumers should know.

Leave a Reply

You must be logged in to post a comment.